How IPL franchises are building sponsor revenue streams that help them diversify apart from the central pool and why that’s the model of the future. ITW Core’s Devanshu Bhatt explains the evolution that seems to be mirroring an international trend.

Manchester City are in a virtuous cycle. They seem to be leading the race for the Premier League title, but the more remarkable aspect is that they topped the list for commercial revenue earned by English football clubs this year. This extra income will enable them to continue to compete with the best teams around the world which will result in better viewership and following for the team, which in turn will result in better commercial performance. It is not an accident that they have dethroned more established ‘brand’ clubs like Manchester United and Liverpool to claim that distinction, in fact this is the result of a well crafted business model – one that might become de rigueur closer home too, in the Indian Premier League.

Different Sport, Same Trend

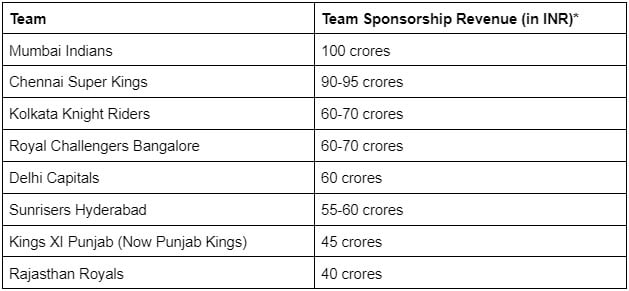

The IPL in the last decade or so has become a commercial behemoth. Driven by an increased appetite for franchise cricket action, reflected in the manifold growth of its audience, the league has generated a huge amount of revenue through its central sponsors – the title sponsors, its official partners, and of course, the sale of TV and digital broadcast rights. However, among individual franchises, who receive about 50% of that central pool revenue cut, the race to be the best is not just on the field, but also on the commercial turf. The best performing teams on the field generally perform the best off it as well. From the IPL sponsorship numbers in 2020, we can see that Mumbai Indians, the best performing franchise at the time, was also the most successful commercially. In fact, just last week, they signed a deal with Slice, for a rumoured Rs. 100 crores, probably the biggest team sponsorship deal in IPL history. So far. A similar trend can be seen holding throughout the table, right to the bottom with Punjab and Rajasthan bringing in the least revenue of any franchise owing to their poor league performances.

Branding Order

However, the on-field performance is just one factor. As mentioned, commercial revenue is a consequence of higher following. Performance is one sure shot way of attracting revenue however, the franchises also took time and energy to cultivate their brand image over the years. Royal Challengers Bangalore might have had mixed performances but they still command a higher commercial revenue owing to the value of their brand, at the centre of which is former captain Virat Kohli, arguably the biggest brand in Indian cricket right now. And this shows. RCB and CSK commanded the most social media engagements of any IPL team last year and were only beaten by the most followed European football teams that have a global audience.

And this is the next goal for the IPL teams. Cricket is on the cusp of truly breaking through as a global sport and as the biggest cricket league in the world, the IPL can lead this revolution. Even within European football, there is a growing realization that most of their audience is consuming the sport remotely. Within the English Premier League, “the big six” teams aren’t always the most consistent teams, but their global fanbase allows them to commercially outperform others. Fans that attend matches in the stadium only make up a small proportion of the true scale of sports consumers. It is the age of the digital fan. This means that clubs have to make the effort to engage with their fans across platforms in unique ways. To bridge that gap, 13 of the lesser known Spanish teams that would otherwise find it harder to distribute their merchandise globally have tied up with Amazon. By leveraging the global giant’s network, they can reach fans that would otherwise find it impossible to buy official merchandise.

Even merchandising is a relatively nascent industry in India. Over the last 2 seasons, fans have finally been able to get their hands on their favourite team’s official merchandise through channels like Amazon, Souled Store and Fancode Shop. However, it has a long way to go in terms of distribution, variety and design. To give an idea of the potential of merchandising, American online merchandising retailer Fanatics is valued at $18 billion. In comparison, the entire IPL ecosystem was valued at $6.2 billion in 2020 by Duff and Phelps.

Beyond The Boundary

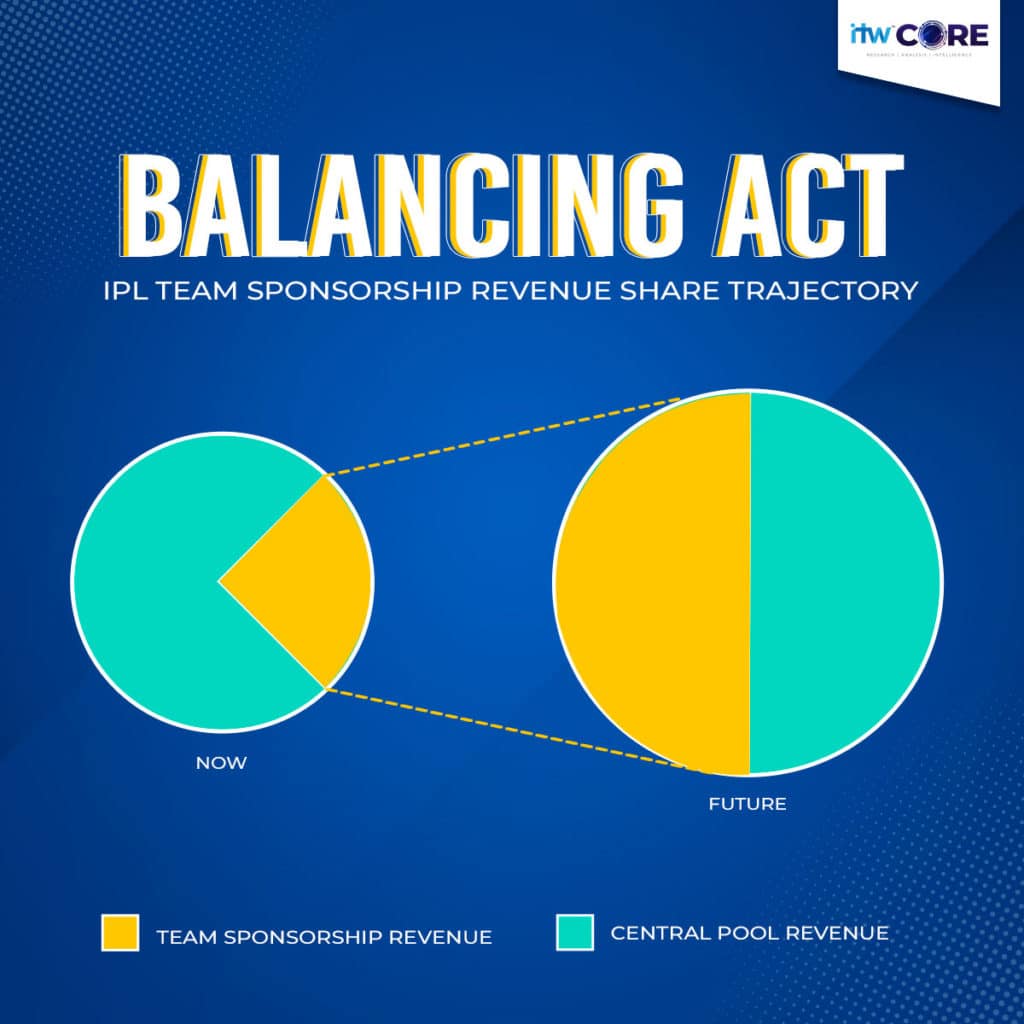

At the moment, at least 75% of an IPL team’s income comes from the central sponsorship and broadcast pool. However, this isn’t in the control of the franchises. Thus, by not nurturing a fan base (both in India and abroad), teams are missing out on significant opportunities. Moreover, by diversifying revenue streams, teams immunize themself from any unexpected reduction in central revenue. Cultivating a more even distribution ensures that the IPL franchises can function as sound businesses for years to come. There is no doubt that this business potential was a significant consideration for the two new IPL franchise owners that splashed out a combined Rs 12,715 crores to acquire them. Despite being the mammoth that it is, IPL’s teams have only scratched the surface when it comes to realizing the potential value of the ecosystem.