How Have The Value of Major Cricket Rights Grown Threefold over the last 5 years? And what does it tell us about the game’s future in general and its broadcast in particular? ITW Core’s Devanshu Bhatt investigates.

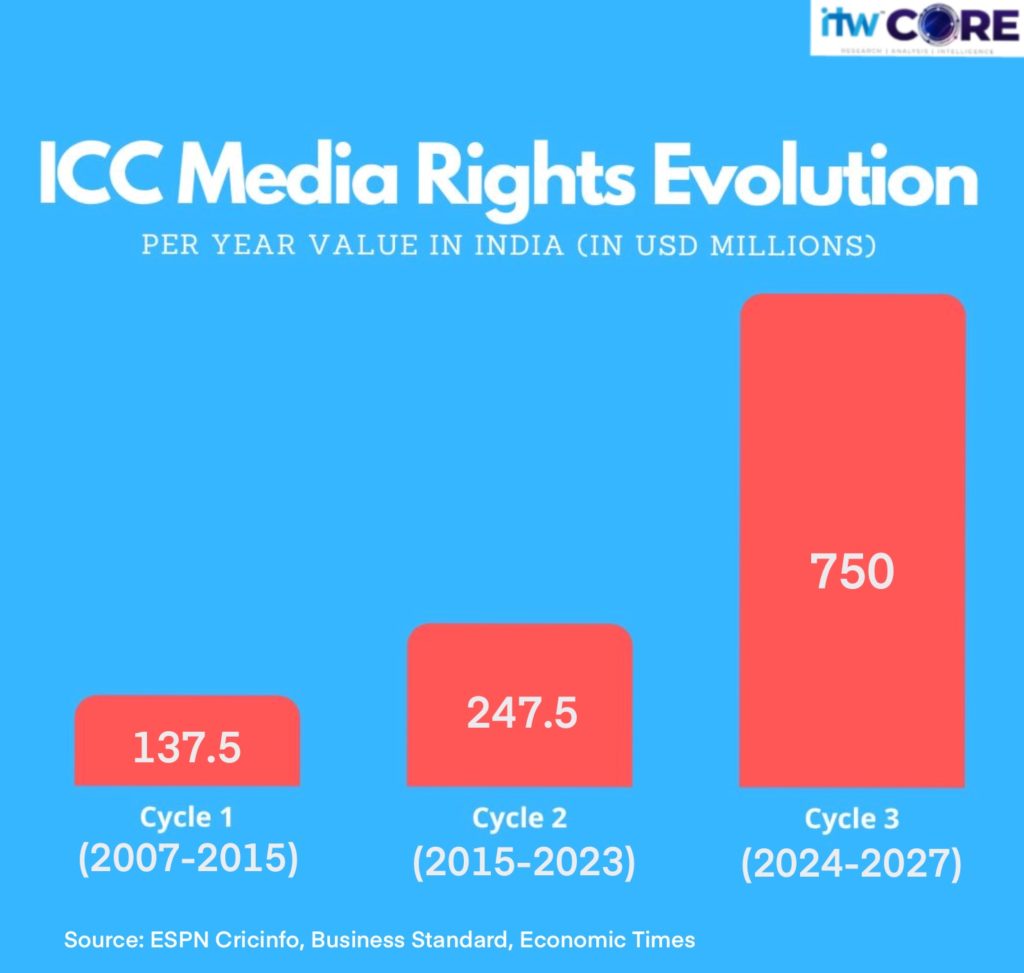

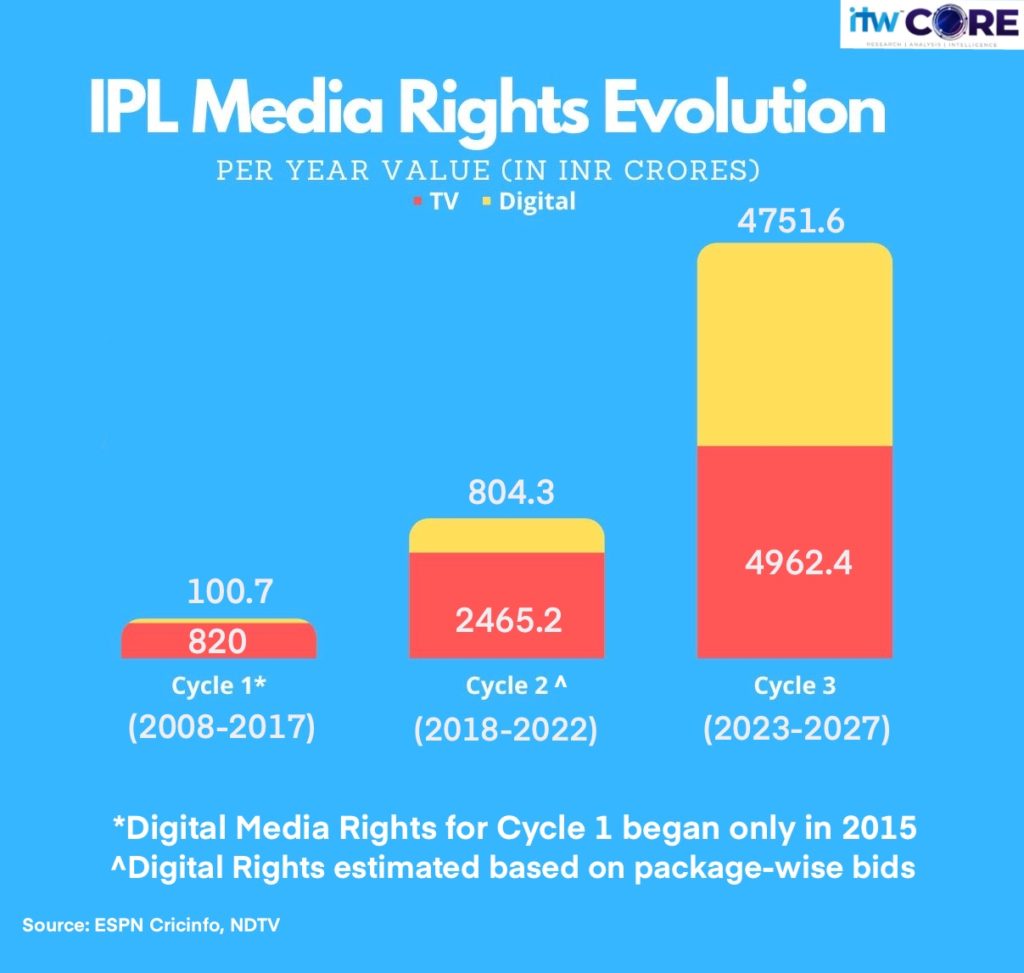

The recent acquisitions of the ICC and IPL Media Rights have been the talk of the town in sports land. And why shouldn’t it be? With around $1.95 billion committed annually between the two, the increase has been a staggering threefold from the previous cycle.

In Perspective

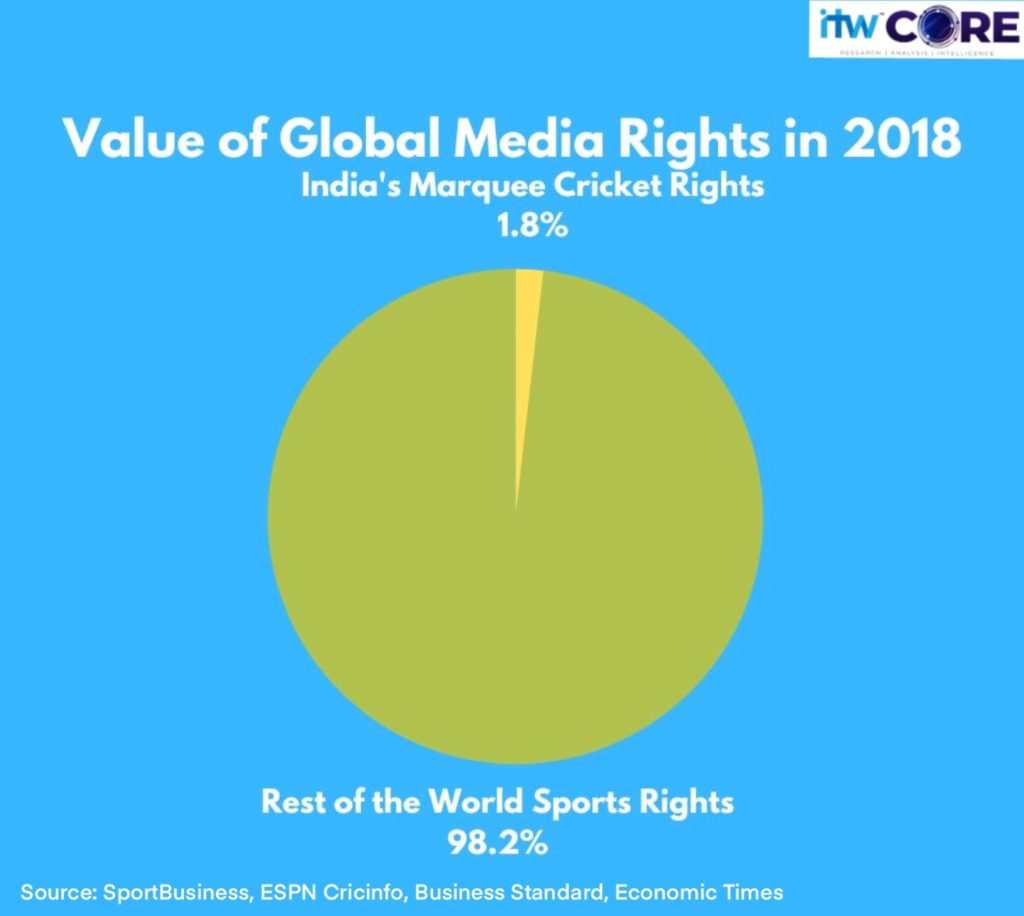

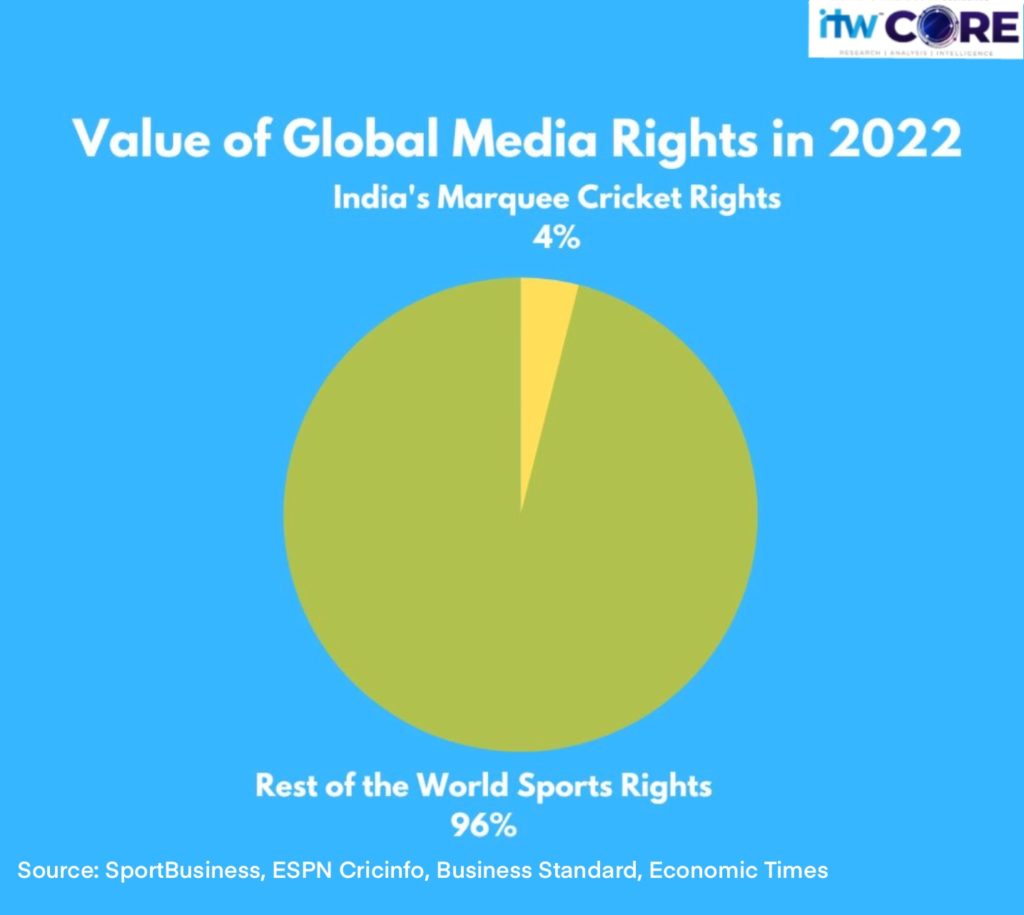

As a percentage of global media rights, in just 4 years India’s marquee cricket rights* alone have more than doubled as a percentage of the growing global sports media rights to go from 1.8% to 4%. And this is before the renewal of the India home series cricket broadcast rights which will happen through an auction next year. If previous trends are anything to go by, the increase in value will be substantial – making Indian cricket an even bigger part of the global sports media pie.

So while a growth in these rights was expected, what explains a 200% rise that even the most optimistic industry experts and analysts had not predicted? It was essentially a conjugation of the following game changing factors:

‘Bout Digital

In both the rights auctions, the real play has been in terms of digital rights driving the growth. It’s all part of the race to capture the next 100 million digital subscribers. Viacom18 paid a record fee for digital rights (INR 23,750 cr) because it was considering both the ad value of the rights because of the advent of targeted advertising as well as a cost of programming. On losing out the digital rights for the IPL, Star attributed a high value to the ICC rights for their programming. And now that they are sub-licensing the TV rights to Zee, it becomes obvious that the play was for the digital rights all along. Considering that the streaming services require a subscription to watch games and these subscriptions last a year – having exciting, marquee programming that garner large audiences every year is a must to stay in the digital race.

Audience Matters

A good portion of the ICC media rights fee increase is due to the increase in interest for women’s cricket in the country of late – a fact that was also acknowledged during Star’s bid for ICC events.

The ICC rights also have another interesting quirk. While India only plays a limited number of games, the total Indian audiences for ICC events rivals that of the IPL. The India vs Pakistan game alone could be enough for viewers to get subscriptions. As demonstrated at the recent Asia Cup encounter where, on OTT, the peak of 14 million viewers was more than 50% higher than the 8.7 million peak viewership for the IPL.

Less means More

The scarcity value of cricket as a marquee property is also a big driver. The number of players in the media landscape has increased in the last few years while the biggest properties remain the same (even if the number of games might go up, the rights are sold together/have more value in exclusivity). Nothing garners audiences and interest quite like live sports and cricket is the king of sports in India (out of the Universe of 766 million sports viewers in India, atleast ~93% watch some form of cricket). This means that advertisers are willing to pay more to tap into this audience – further driving up the value of these rights.

The increase in the number of broadcasters for different events means that viewers will have to access different services for their sports. This will ultimately continue to drive up the value of the sports media landscape. As cricket properties are limited, broadcasters might now look at other, non-cricket sports properties to distinguish themselves. This means more attention to the production and promotion of these sports, ultimately benefiting sports in the country as a whole.

The Sports Drive

For broadcasters, these properties will prove to be a key driver of subscriptions as they prove to be a consistent driver of subscribers because of the cyclical nature of these events. And ultimately, once users are tied into their year long subscriptions, they will also view other, recurring content like shows and movies. This will make them loyal, or as they say in the programming parlance, more sticky. So this whole $10-12 billion playground over the next 5 years is to establish the platform to serve cricket’s digital first audience and find new ways to engage and then monetize them. Think of this spend as the spend on a highway network on which Indian sport’s broadcast commerce will run over the next decade.

*IPL + ICC Tournaments India is a part of + India home series